The complex weave of family bonds, strengthened with threads of common heritage, love, and sometimes deep contention, can unfortunately come undone. Whereas traditions are commonly envisioned to pass along effortlessly across generations, reality for many families involves a difficult situation referred to as estrangement.

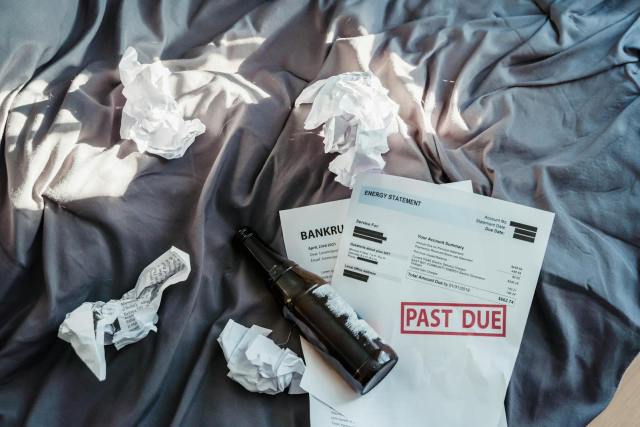

This profound divide between relatives a condition of emotional or physical disconnection creates complex challenges, particularly when it crosses with issues of inheritance and estate planning. It’s an environment that is filled with emotional nuances and legalities that need to be addressed with caution and knowledge.

In psychology, how these dynamics play out makes sense of the human aspect of such splits, and law of estates gives the means by which wishes are to be respected. This article broaches this delicate ground, shedding light on the legal entitlement of estranged family members and workable strategies in dealing with such relationships in your estate plan.

1. Defining Estrangement: The Unseen Rift in Family Bonds

Estrangement is worse than a transient disagreement; it represents “the state of being alienated or separated in feeling or affection; a state of hostility or unfriendliness” or “the state of being separated or removed.” Emotional bonds may tangle and even break, but estrangement does not terminate a relationship legally.

Think of a husband who leaves and restricts contact with his children and wife, or a child who, having been abused, stays away from a parent. Alternatively, a parent may disengage from a child who is engaged in criminal activities or has betrayed them extremely badly. These are profoundly sad but more and more frequent situations.

Even without contact, the legal relationship can continue. Most are surprised to discover that separation or lack of contact usually does not reduce the estranged spouse’s or child’s legal right to inherit unless there is an explicit estate plan with disinheritance.

2. The Unexpected Heir: Legal Rights of Estranged Spouses

If a dying spouse dies without an estate plan, state intestate succession laws control asset distribution. A surviving spouse inherits, even if they were estranged or legally separated when dying. In most states, this holds true regardless of the length or bitterness of the separation.

If the couple did not have any children, the surviving spouse might take the whole estate. With children, both the spouse and children inherit as per statute. Under community property states, a spouse could get all community property, with separate property possibly being divided.

Other states also have protection for surviving spouses by virtue of “pretermitted spouse” laws, which cover those inadvertently left out of a will. Even if a will is intended to disinherit, “elective share” laws usually permit a spouse to take a specified percentage typically 30 to 50 percent of the estate. Florida states even count trusts, life insurance, and retirement plans in this determination, so disinheritance without comprehensive planning is challenging.

3. Estranged Children’s Claims: Inheritance Rights of Estranged Children

Similar to spouses, estranged children still have inheritance rights in case a parent passes away without an estate plan. They can inherit under intestate laws despite years of estrangement.

Certain states also have “pretermitted child” statutes to safeguard children accidentally left out of a will, for instance, children born after the will’s preparation. The child could inherit as though no will had been made if the will is not revised. Yet this protection vanishes where the will explicitly indicates an intent to disinherit. Otherwise, an estranged child could inherit a share in the circumstances specified.

4. Proactive Planning: Crafting an Estate Plan to Reflect Your Intentions

Preventing an estranged family member from inheriting requires a clear, enforceable estate plan. This often involves a will explicitly stating disinheritance intentions or a trust that excludes the individual.

For alienated spouses, elective share laws make things tougher. One ploy is to provide an inheritance that is the statutory fraction to prevent argument. In states that restrict elective shares to the probate estate, providing alternate beneficiaries to retirement plans, trust property, and insurance can evade the spouse. Lifetime gifts, prenuptial agreements, and marital contracts also work. For children, an express disinheritance clause and perhaps a small inheritance with a no-contest clause will discourage court challenges.

5. Divorce vs. Separation: The Key Distinction for Disinheritance

In most states, such as New York, spouses who are separated are still legally married and maintain their inheritance rights even if specifically named for disinheritance in a will. Complete disinheritance is generally not possible until after a divorce is final. Wills made prior to divorce finalization can be challenged if not revised subsequently. To prevent the complete protection of claims, complete divorce proceedings before finalizing a thorough estate plan.

6. Navigating the Aftermath: Finding Estate Details After the Loss

The loss of a estranged parent is filled with emotional and legal undertows. The initial step toward comprehending rights is finding estate details. Probate court documents in the resident county will verify whether an estate was opened, a will filed, and an executor named.

Reaching out to known relatives, friends, or attorney contacts might provide information informally. Obtaining the death certificate and financial or property documents can help put the estate’s picture together and inform what to do next.

7. The Power of Your Will: Shaping Assets and Disinheritance

A valid will prevails over asset distribution and supersedes default laws. It provides for specific bequests and residuary clauses for leftover assets. Most importantly, it can specifically disinherit a person. For the disinheritance clause to work, it must clearly identify the individual and state he or she gets nothing. Without it, default laws might permit claims despite what the deceased wants.

8. When There’s No Will: Understanding Intestacy and Its Implications

If a person passes away without an effective will, laws of intestacy distribute heirs in a predetermined order spouse, children, parents, and others. Estranged children usually remain in contention unless parental rights were legally severed. The court appoints an administrator to divide assets strictly based on these laws.

9. Estate Debts and Liabilities: The Unseen Claims

Before anyone inherits, debts must be paid by the estate. Executors or administrators alert creditors and settle valid claims within statutory time limits. Heirs, estranged children among them, are usually not individually liable for debts unless they co-signed or had a joint account. If assets are not enough, unpaid debts are typically forgiven.

10. Disclaiming an Inheritance: A Choice of Renunciation

An heir may lawfully disclaim an inheritance, normally for tax, personal, or practical motives. The disclaimer should be in written form, submitted within a stipulated time usually nine months and is typically irrevocable. Disclaimed property subsequently passes as if the individual predeceased the decedent, distributing to the following in line.

11. The Emotional Landscape: Parents and Estranged Children

Parents usually go through great emotional struggle when determining whether to leave property to a estranged child. Some see it as reconciliatory; others as rewarding bad behavior. Estranged children might also view money as “toxic,” associated with bad memories. Others spend their assets while they are alive, sidestepping posthumous battles.

12. Managing Fairness: Transferring Assets to Estranged Children

In estrangement situations, sentimental possessions can be worthless to the child. Parents might opt for selling or donating possessions, so they are valued elsewhere. With more than one child, fairness is complicated some will leave less to an estranged child or give outright to that child’s children. Conditions on gifts or exclusions are also in the plan.

13. Preventing Will Contests: Proactive Measures for a Solid Plan

To minimize controversy, confirm testamentary capacity is properly recorded, perhaps by way of medical assessment. No-contest provisions can discourage challenges, and impartial witnesses enhance the validity of the will. Unambiguous communication or written descriptions can resolve misunderstandings. Trusts offer secrecy and are more difficult to challenge. A protective estate planning attorney can customize safeguards for each case.

14. Countering Will Contests: Strategic Moves in Litigation

If a will is challenged, hire an estate lawyer pronto. Gather medical records, witness accounts, attorney memos, and earlier wills to refute assertions. Assess the merits of the contest before going forward, and think about settlements to conserve time, expenses, and anxiety and uphold the intentions of the deceased.

15. The Important Role of Legal Counsel in Complicated Estates

Skilled legal representation is crucial when estrangement makes inheritance problematic. Lawyers make sure wills are legal, foresee problems, and include preventive clauses. Lawyers give unbiased advice, facilitate disputes, and advocate for estates in court, preserving the deceased’s intentions and establishing a clear, enforceable plan.